Navigating the complexities of the SETC initiative can be a daunting challenge. With significant financial incentives at play, ensuring adequate safeguards against potential oversights is paramount. In New York, targeted malpractice insurance policies are available to safeguard businesses and individuals involved in the SETC program from potential legal repercussions. These coverage options provide a crucial safety net against unforeseen circumstances.

A comprehensive New York insurance policy tailored to protect against SETC tax credit errors will typically contain coverage for a variety of conceivable liabilities. This can cover defense costs associated with lawsuits, as well as settlements that may arise from malpractice claims.

- Identifying a reputable insurance provider with expertise in the SETC tax credit program is crucial.

- Carefully review the policy provisions to ensure adequate coverage for your specific requirements.

- Maintain meticulous records of all SETC program related activities to facilitate any potential legal proceedings.

State Telehealth Liability: COVID Rebate for Providers

As the public health emergency continues to impact healthcare delivery in the Golden State, telehealth has emerged as a critical tool for providing care to patients. In an effort to support providers and encourage the use of telehealth, California has implemented a COVID-19 rebate program.

This program aims to reimburse providers for financial burdens associated with providing telehealth care during the ongoing pandemic. The rebate program is intended to help bridge the gap for healthcare providers who have integrated telehealth into their practice.

- Healthcare professionals

- Remote care

- Rebate program

Texas Contractor Insurance Agencies & SETC 2021 Compliance

Navigating the complex world of contractor insurance in Texas can be a struggle, especially with the ever-evolving landscape dictated by the Safety Enhanced Training Certification (SETC) program. As of mid 2021, all contractors working on public projects in Texas are required to comply with SETC standards. This means you'll need an insurance plan that meets the unique demands of SETC compliance.

Choosing the right contractor insurance agency can make all the difference. A reputable agency will possess a deep understanding of Texas codes and the specific policies required for SETC compliance.

- When looking for a contractor insurance agency in Texas, consider these factors:

- Knowledge in the construction industry and SETC compliance

- Affordable pricing choices

- An strong track record of client satisfaction

Obtaining Your SETC Tax Refund

Are you a Florida Therapist Coverage Sellers ? Did you make contributions to the State Employee Tuition Assistance Program (SETC) during the tax year? If so, you may be eligible for a SETC tax refund! This program provides valuable financial aid to help cover education expenses for qualified employees.

To ensureyou're properly prepared for your SETC tax refund, follow these straightforward steps:

* Gather all necessary documentation, including your W-2 form and any relevant receipts or invoices related to your contributions.

* Complete the SETC Tax Refund Application form accurately and completely.

* Submit your more info completed application along with supporting documents to the designated agency by the deadline.

Remember , timely submission is crucialto maximize. By following these steps, you can confidently claim your SETC tax refund and put those funds towards future educational endeavors.

Secure Your Practice: SETC Tax Credit Malpractice Insurance in NY

Operating a medical practice in New York comes with inherent challenges. Navigating the complex landscape of the SETC tax credit program can be particularly tricky. Should a miscalculation occur, you could face potential malpractice claims. That's where specialized protection steps in. By securing SETC Tax Credit Malpractice Protection, you can safeguard your practice from financial repercussions. This type of policy provides vital coverage against claims arising from errors or omissions related to the SETC tax credit program.

- Benefits of SETC Tax Credit Malpractice Protection:

- Financial stability

- Reassurance of mind knowing your practice is covered

- Access to legal experts

Consult with a qualified insurance today to review your options and find the best SETC Tax Credit Malpractice Protection policy for your requirements.

Take Advantage of Cost-Savings : California's COVID Telehealth Provider Rebate

California residents who utilized telehealth services during the height of the COVID-19 pandemic may be entitled for a generous rebate. This program, implemented by the state to encourage the adoption of telehealth, offers financial rewards to consumers who received virtual healthcare. To avail yourself of this rebate opportunity, meticulously review the criteria outlined by the California Department of Health Care Services.

- Essential factors to {consider|:comprise include your healthcare provider's participation in the program, the type of telehealth consultation you received, and the total amount incurred during the designated period.

- Refrain from postpone in submitting your form. The deadline to apply for the rebate is soon

- Leverage advantage of digital tools provided by the California Department of Health Care Services to navigate the application system.

Haley Joel Osment Then & Now!

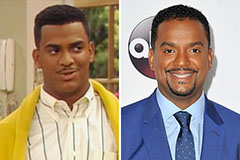

Haley Joel Osment Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!